Marketing Dashboards: A Complete Guide to PPC Metrics Across All Major Platforms

Every day, businesses spend billions of dollars on digital advertising yet most marketers understand less than half of what their dashboards are telling them. The difference between a profitable advertising account and one that burns cash isn’t budget size or creative genius. It’s dashboard literacy.

Performance marketing dashboards are the control centers of modern digital advertising, containing everything you need to transform raw spend into measurable revenue. But here’s the challenge: these interfaces are deliberately complex, packed with hundreds of metrics, nested hierarchies, and algorithmic recommendations that can either multiply your effectiveness or bury you in noise. Whether you’re managing Google Ads, Meta, TikTok, LinkedIn, or any major advertising platform, the fundamental principles remain the same master the dashboard, master the channel.

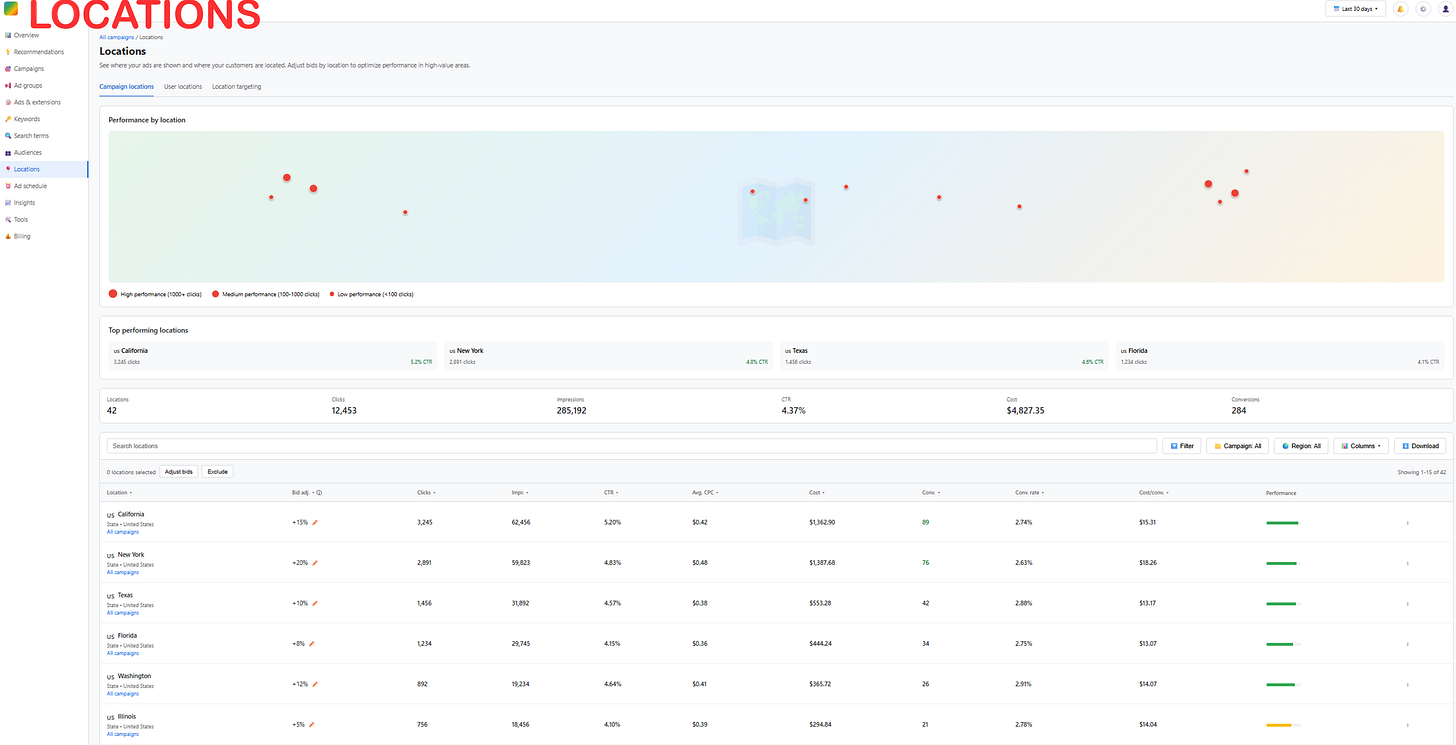

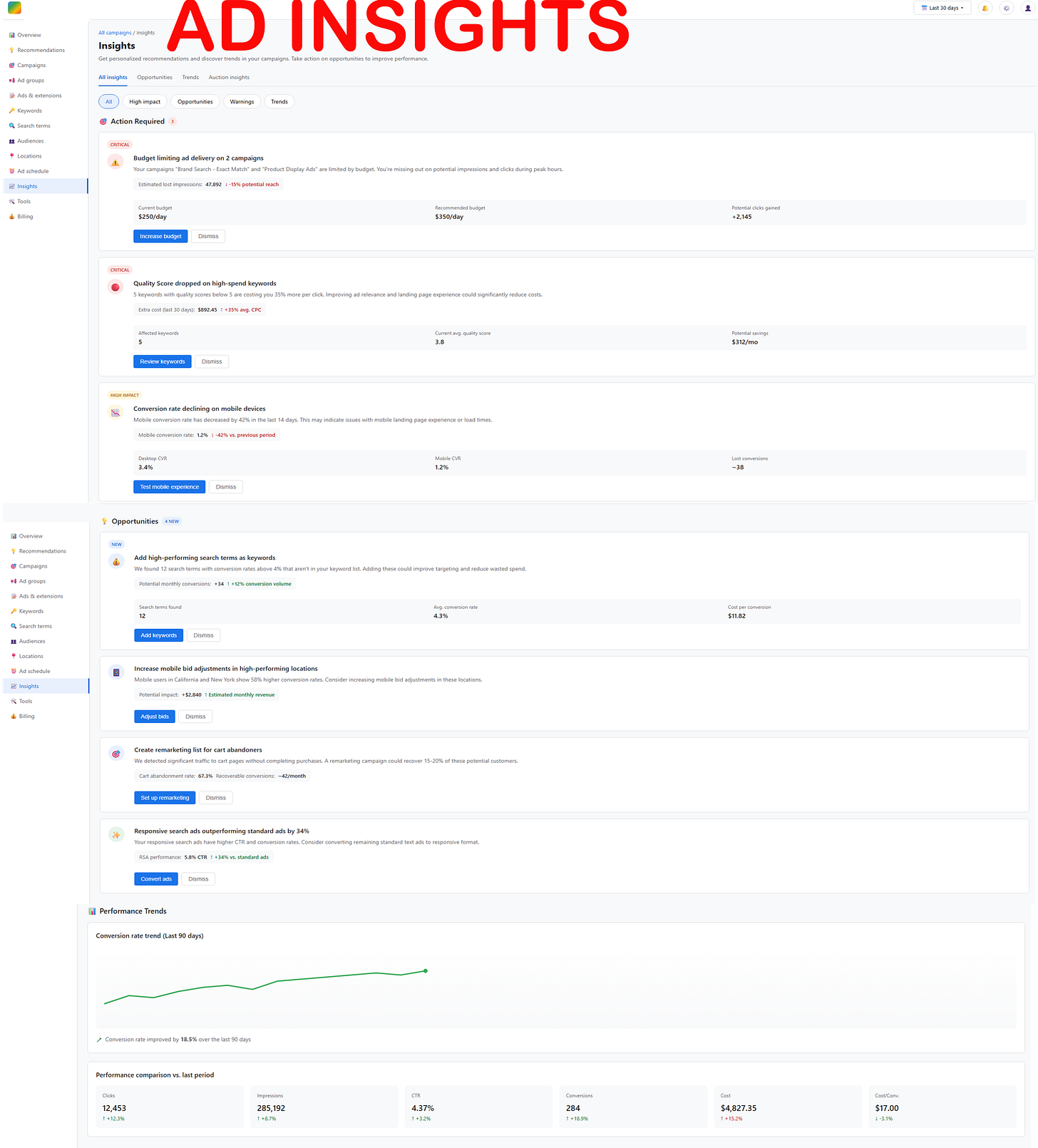

This guide exists because dashboard confusion is expensive. When you don’t understand what Quality Score means, you overpay for every click. When you miss that your mobile conversion rate dropped 42%, you hemorrhage thousands in wasted spend. When you ignore geographic performance variations, you fund inefficient markets while starving your best opportunities. These aren’t hypothetical scenarios they’re the daily reality of accounts managed by marketers who treat dashboards as reporting tools rather than optimization engines.

The stakes are straightforward: advertisers who deeply understand their dashboards achieve 2-3x better ROI than those who don’t. They scale campaigns profitably while competitors hit efficiency ceilings. They identify problems in hours rather than months. They automate the repetitive work and focus human intelligence on strategic decisions that actually move business metrics.

What This Guide Covers

We’ll deconstruct every major view in modern advertising dashboards, from the overview metrics that provide your performance pulse to the granular keyword and search term data where optimization actually happens. You’ll learn not just what each metric means, but what to do with it how to diagnose problems, identify opportunities, and implement changes that demonstrably improve results.

This isn’t theory. Every insight in this guide comes from managing millions in ad spend across hundreds of accounts. We’ll show you exactly what professional performance marketers look at daily, what patterns indicate opportunities versus problems, and what actions drive the biggest performance improvements. You’ll understand the strategic reasoning behind bid adjustments, budget allocations, audience targeting, and creative optimization.

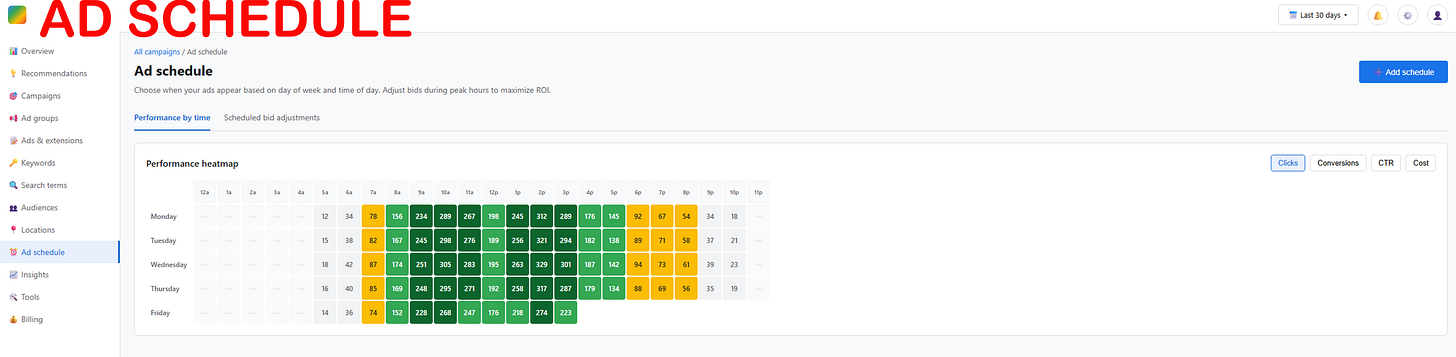

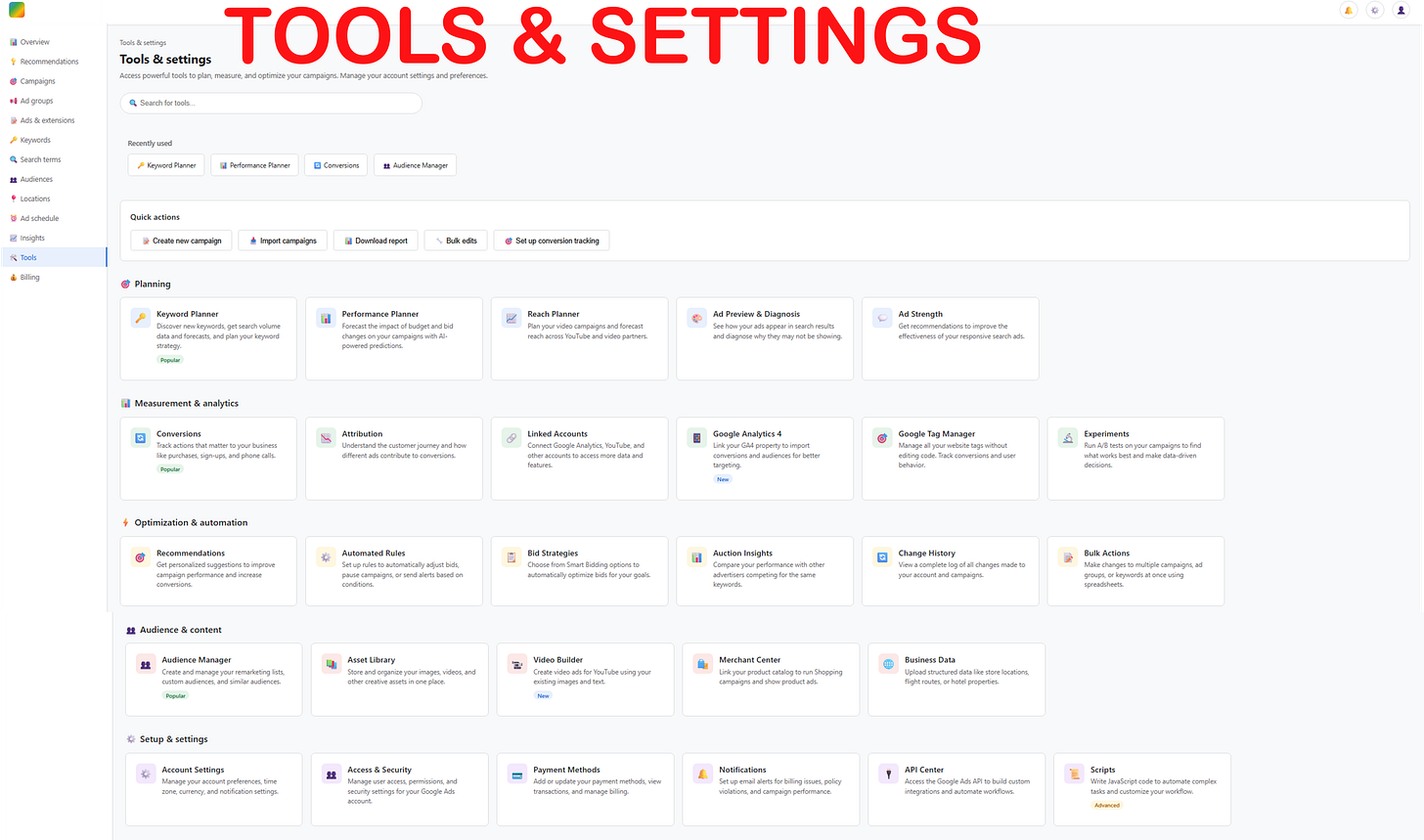

We’ll cover the complete dashboard hierarchy: overview metrics that show account health at a glance, campaign-level data for strategic budget allocation, ad group granularity for targeting precision, individual ad performance for creative testing, keyword economics for search advertising optimization, audience segmentation for behavioral targeting, geographic intelligence for market-by-market strategy, temporal patterns for scheduling optimization, and AI-powered insights that surface opportunities human analysis might miss.

Whether you’re a beginner trying to understand your first campaign or an experienced marketer optimizing sophisticated accounts, this guide will elevate your dashboard fluency. By the end, you won’t just read dashboards you’ll interrogate them, extracting the intelligence that transforms advertising from an expense into a growth engine.

The complexity is the point. Dashboards are complex because digital advertising is multidimensional optimization across dozens of variables audiences, keywords, locations, devices, times, creatives, and bids all interacting in real-time auctions against competitors doing the same calculations. The marketers who thrive aren’t those who simplify this complexity away they’re those who embrace it, developing the systematic approaches that turn complexity into competitive advantage.

Let’s begin by understanding the foundation: the overview metrics that tell you whether your advertising is working at all.

THE DASHBOARD

Understanding performance marketing dashboards is the difference between burning budget and building profitable campaigns. Whether you’re managing Google Ads, Meta, TikTok, YouTube, LinkedIn, Microsoft Ads, Amazon, or Pinterest, each platform has unique metrics, interfaces, and optimization opportunities. This guide provides comprehensive insights into every major advertising dashboard, helping marketers from beginners to experts navigate the complexity of modern paid advertising with confidence.

The advertising dashboard represents a comprehensive command center for performance marketing, and understanding each element is crucial for optimizing campaign performance and ROI.

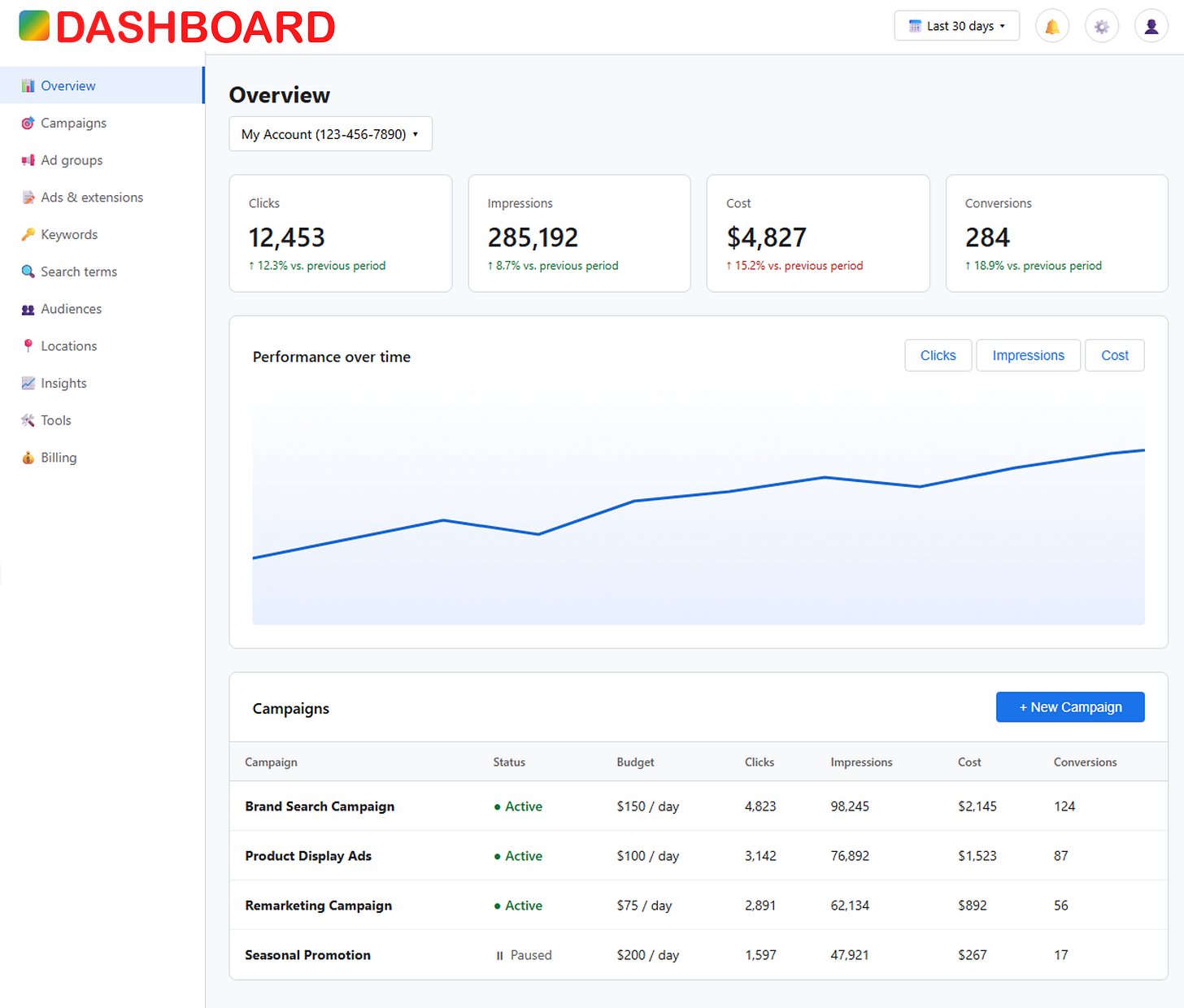

The Overview Metrics Section

At the top of the dashboard, you’ll find four key performance indicators that provide an immediate snapshot of your account health. The Clicks metric (12,453) shows how many times users have actually engaged with your ads by clicking through, with a healthy 12.3% increase versus the previous period indicating growing engagement. Impressions (285,192) represent the total number of times your ads were displayed to users, showing an 8.7% increase and indicating expanding reach. The Cost metric ($4,827) is your total ad spend for the period, up 15.2%, which you’ll want to correlate with your conversion growth to ensure efficiency. Finally, Conversions (284) are your bottom-line results the actual desired actions taken, whether that’s purchases, sign-ups, or leads showing an impressive 18.9% increase. As a performance marketer, you should constantly monitor the relationship between these metrics: if cost increases faster than conversions, your efficiency is declining; if conversions grow faster than cost, you’re improving performance.

Performance Over Time Graph

The line graph in the middle section is your trend analysis tool, allowing you to visualize how clicks, impressions, or cost have changed throughout the selected time period. The tabs at the top right let you switch between these metrics to identify patterns, seasonality, or anomalies. A performance marketer should look for correlations here for instance, if you see a dip in the graph, cross-reference it with external factors like weekends, holidays, or budget changes. The upward trajectory shown indicates consistent growth, which is positive, but you’d want to ensure this growth is sustainable and profitable by checking it against your conversion data and cost per acquisition targets.

Campaign-Level Breakdown

The campaigns table at the bottom is where tactical optimization happens. Each campaign is listed with its status (Active or Paused), daily budget, and individual performance metrics. The Brand Search Campaign with its $150 daily budget is generating 4,823 clicks and 124 conversions at a cost of $2,145, giving you a cost per conversion of approximately $17.30. Product Display Ads, running at $100 per day, shows 87 conversions from 3,142 clicks, indicating a conversion rate of about 2.8% and a cost per conversion of around $17.50. The Remarketing Campaign at $75 daily spend shows lower conversion volume (56) but is typically your most efficient channel since it targets users who’ve already shown interest. The Seasonal Promotion campaign is paused, which means it’s either completed its run or underperforming as a performance marketer, you’d want to analyze whether to restart it with optimizations or reallocate that $200 daily budget to better-performing campaigns.

Strategic Decision-Making

A professional performance marketer would use this dashboard to make data-driven decisions daily. You’d calculate critical efficiency metrics like CTR (click-through rate: clicks divided by impressions), CPC (cost per click), conversion rate (conversions divided by clicks), and CPA (cost per acquisition). With this data, you’d identify that while the Brand Search Campaign has the highest volume, you should compare its efficiency to the Remarketing Campaign to determine optimal budget allocation. The “+ New Campaign” button in the top right is your pathway to scaling but only after you’ve validated what’s working in your existing campaigns. You’d also use the time period selector (currently set to “Last 30 days”) to compare performance across different windows and identify long-term trends versus short-term fluctuations. The key is maintaining a balance between spending enough to generate meaningful data while staying efficient enough to remain profitable, constantly testing, iterating, and reallocating budget toward your best performers.

THE CAMPAIGN

The campaigns view is the operational heartbeat of performance marketing, where you manage, optimize, and scale your advertising efforts at a granular level. Understanding how to read and act on this data separates average marketers from high-performers.

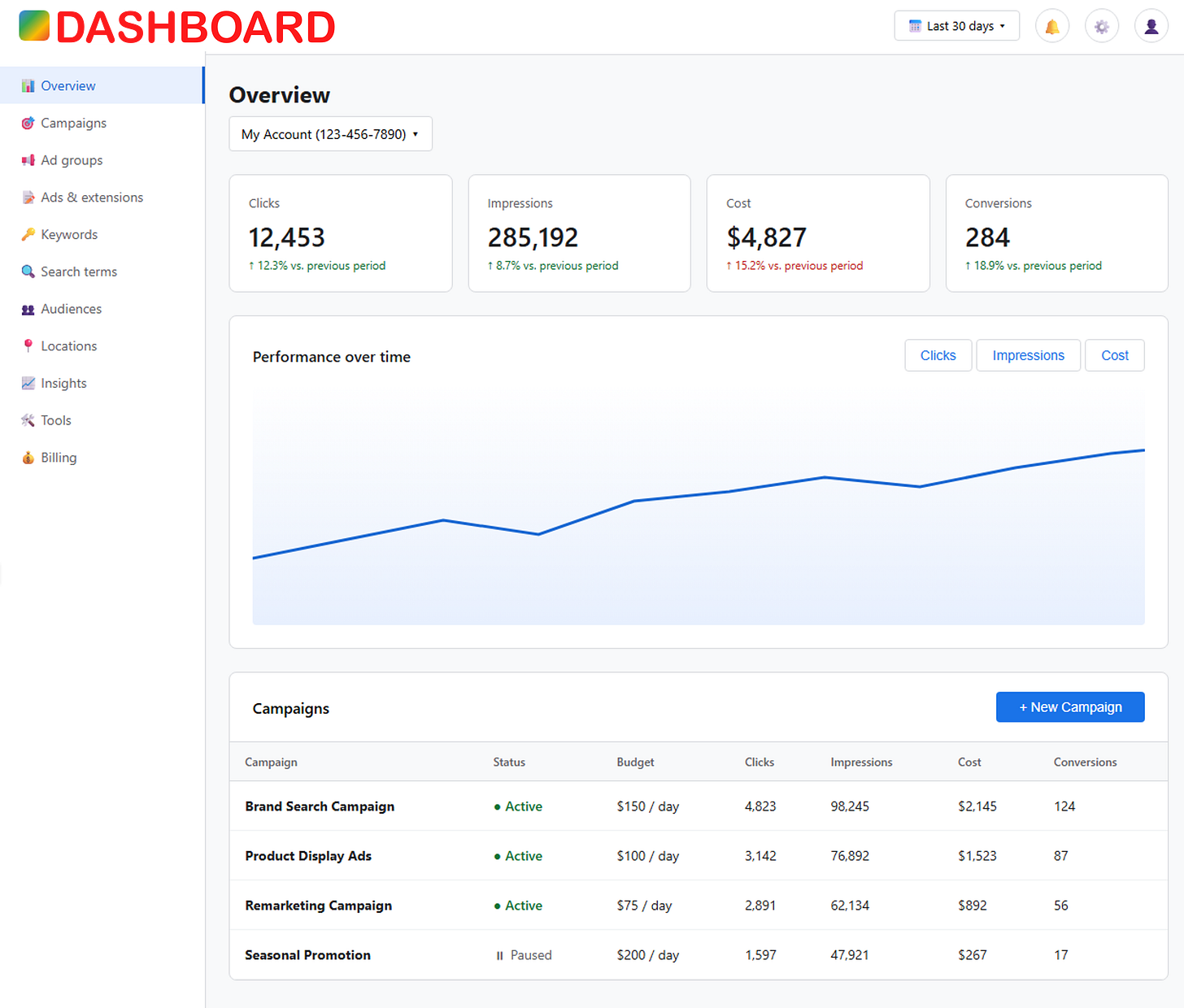

The Summary Section

At the top, you see aggregated performance across all 8 campaigns: 12,453 total clicks, 285,192 impressions, $4,827.35 in spend, and 284 conversions. The critical metric here is Cost/conv. at $17.00, which represents your average cost per acquisition across all campaigns. This is your benchmark every individual campaign should be evaluated against this number. If a campaign’s cost per conversion is significantly higher than $17.00, it’s dragging down your overall efficiency and needs optimization or pausing. If it’s lower, that campaign deserves more budget. This aggregate view helps you understand your blended efficiency, but the real optimization work happens at the individual campaign level below.

Campaign Management Controls

The tabs at the top (All campaigns, Draft campaigns, Experiments) let you organize your work. Draft campaigns are where you build and test new initiatives before launching them live, while Experiments is where you’d run controlled A/B tests. The search bar, Filter, Columns, and Download buttons give you powerful data manipulation tools as campaigns scale into dozens or hundreds, you’ll use filters to quickly segment by performance, status, or campaign type. The bulk action buttons (Edit, Enable, Pause, Remove) allow efficient management when you need to make changes across multiple campaigns simultaneously, which is essential when you’re managing large accounts.

The Campaign Table Structure

Each row represents an individual campaign with its complete performance story. The checkbox on the left lets you select campaigns for bulk actions. The campaign name and type (Search, Display, Shopping, Video) tell you the ad format and targeting approach. The Status column shows whether campaigns are Active, Paused, or Ended Active campaigns with green indicators are currently spending and serving ads, while Paused campaigns (like Competitor Keywords) are on hold. The small pencil icon next to the budget indicates you can quickly edit without entering the full campaign settings, allowing for rapid budget adjustments based on performance.

Budget Analysis and Allocation

The Budget column reveals your daily spending limits, ranging from $50.00 (Video - Product Demo) to $300.00 (Summer Sale 2025). A performance marketer should constantly evaluate budget allocation based on efficiency and scale potential. Notice that the Brand Search - Exact Match campaign, with a $150 daily budget, generates 124 conversions at $17.30 each, while the Shopping - All Products campaign at $200 daily only generates 12 conversions at $13.02 each. Despite Shopping having a better CPA, it’s not scaling as well, suggesting either limited inventory, restrictive targeting, or market saturation. You’d want to investigate whether increasing its budget would maintain that efficiency or if there are structural limitations preventing scale.

Performance Metrics Deep Dive

The Clicks, Impressions, and CTR columns work together to tell your engagement story. The Brand Search campaign has a strong 4.91% CTR, indicating highly relevant ad copy and targeting, while the Shopping campaign’s 3.47% CTR suggests room for improvement in product feed optimization or ad creative. The Avg. CPC column shows what you’re paying per click the Remarketing campaign at $0.31 is incredibly efficient because you’re targeting warm audiences, while Competitor Keywords at $0.67 is more expensive due to competitive bidding on rival brand terms. The Cost column shows total spend to date, and the Conv. column shows absolute conversion volume, but the Cost/conv. column is where optimization decisions are made.

Identifying Winners and Losers

Looking at cost per conversion, your Remarketing - Website Visitors campaign at $15.93 is performing better than the $17.00 account average, making it a strong candidate for budget increases. The Video - Product Demo at $17.91 is slightly above average but with only 4 conversions, the sample size is too small to make definitive decisions you’d want to let it run longer to gather statistical significance. The Competitor Keywords campaign at $28.15 per conversion is dramatically underperforming, which explains why it’s paused. However, don’t immediately write it off; sometimes competitor campaigns have strategic value for brand defense or market share protection, even at higher CPAs. The Performance Max campaign with 0 conversions is concerning and needs immediate attention it’s spending money ($10.07) without returns, suggesting targeting issues, creative problems, or insufficient tracking setup.

Campaign Type Strategy

The variety of campaign types shown here represents a sophisticated full-funnel approach. Search campaigns (Brand Search, Competitor Keywords) capture high-intent users actively looking for solutions. Display campaigns (Product Display Ads, Remarketing) build awareness and re-engage previous visitors. Shopping campaigns push product inventory directly into search results with images and prices. Video campaigns build engagement and brand consideration. Performance Max campaigns use Google’s automation across all channels. A professional performance marketer understands that each campaign type serves different funnel stages and should be measured against appropriate benchmarks remarketing should have lower CPAs than cold prospecting, brand search should convert better than competitor search, and awareness campaigns may not convert immediately but contribute to assisted conversions.

The Ended Campaign Signal

The Summer Sale 2025 campaign with an “Ended” status and red indicator shows completed seasonal activity. With only 14 clicks, 488 impressions, and 0 conversions from $0.98 spend, this appears to have ended prematurely or suffered from severe delivery issues. A performance marketer would investigate whether this was intentionally stopped due to poor performance, ran out of budget, or hit date restrictions. The $300 daily budget suggests it was meant to be a major initiative, so understanding why it failed is critical for future seasonal planning.

Action-Oriented Decision Making

Using this dashboard effectively means making daily optimization decisions based on the data. You’d increase budgets on Remarketing and Brand Search campaigns that are efficient and scalable. You’d investigate and potentially pause the Performance Max campaign if it continues not converting. You’d test restarting Competitor Keywords with refined targeting or creative to improve that $28.15 CPA. You’d analyze why Shopping isn’t scaling despite good efficiency and potentially adjust product feed, bidding strategy, or targeting. You’d monitor the Video campaign until it reaches statistical significance before making budget decisions. The three-dot menu on the right of each row provides quick access to detailed settings, allowing you to drill into ad copy, keywords, audiences, and bidding strategies for each campaign. This campaigns view is where strategy meets execution, and mastering it means constantly balancing the tension between spending enough to generate results while maintaining the efficiency that drives profitable growth.

THE AD GROUPS

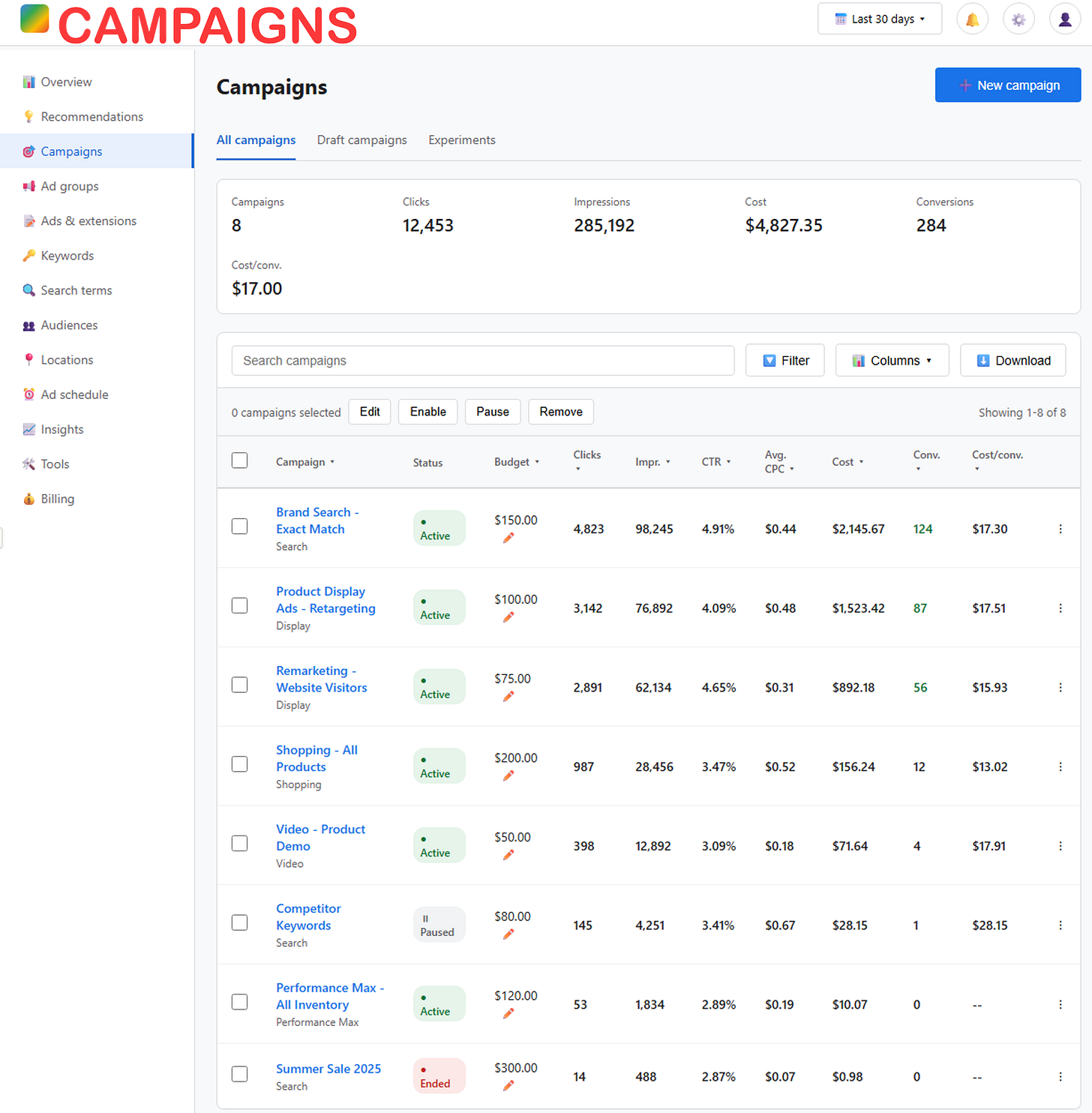

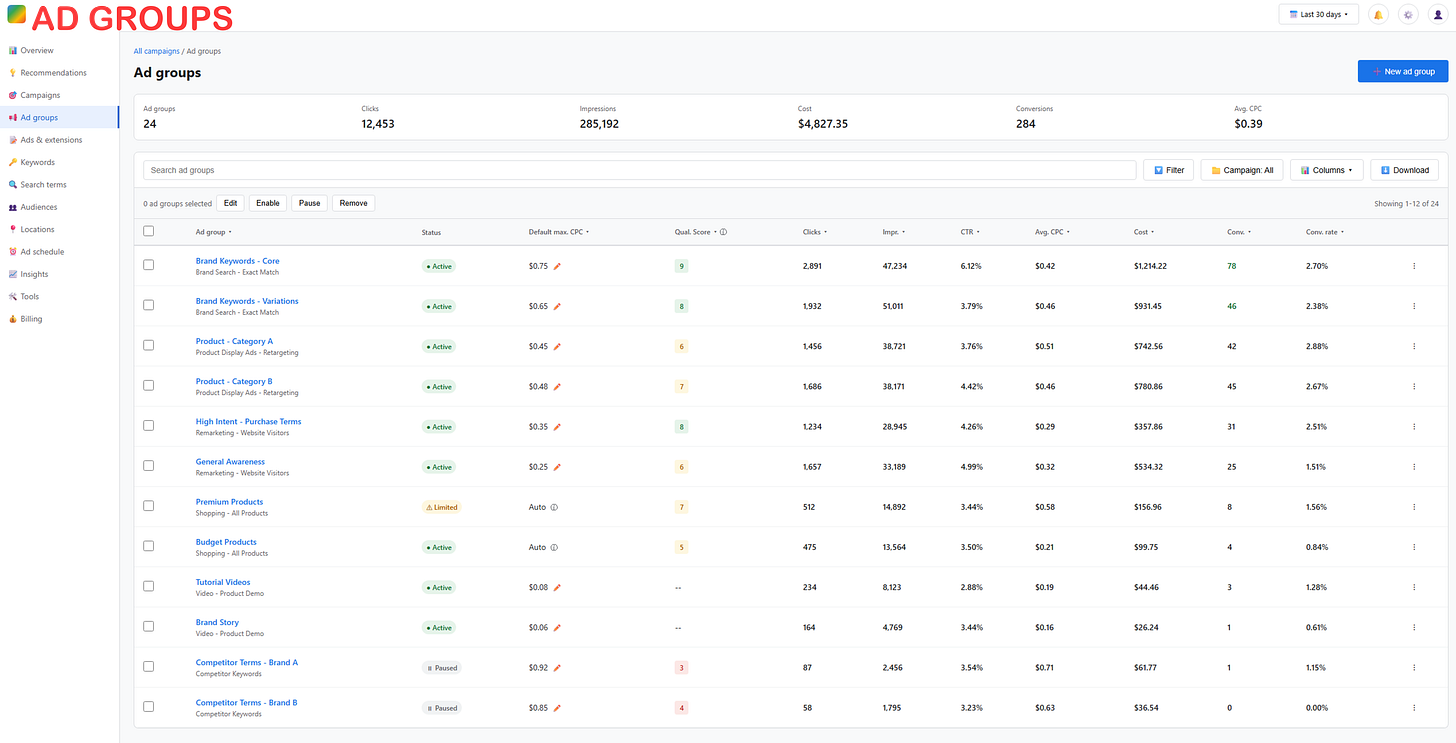

The Ad Groups view is where performance marketing becomes surgical this is the level at which you control targeting precision, bid strategies, and audience segmentation within your campaigns. Mastering ad group optimization is what separates tactical executors from strategic performance marketers who can scale profitably.

The Strategic Purpose of Ad Groups

Ad groups sit between campaigns and individual keywords or audiences, allowing you to organize your advertising around specific themes, products, or customer segments. Each ad group contains related keywords or targeting criteria along with tailored ad creative that speaks directly to that audience’s intent. The 24 ad groups shown here represent different strategic bets across your various campaigns, each with its own performance profile and optimization opportunities.

Summary Metrics Overview

The top banner shows your aggregate ad group performance: 24 total ad groups generating 12,453 clicks, 285,192 impressions, $4,827.35 in spend, 284 conversions, and a $0.39 average CPC. This average CPC of $0.39 is a crucial efficiency benchmark ad groups significantly above this number may have bidding issues, poor Quality Scores, or be targeting highly competitive keywords. The fact that you can see individual ad groups ranging from $0.06 (Brand Story) to $0.75 (Brand Keywords - Core) reveals massive variance in your cost structure, which presents both risks and optimization opportunities.

Quality Score Intelligence

The Qual. Score column is one of the most critical yet underutilized metrics in performance marketing. Quality Score (on a 1-10 scale, with 10 being perfect) measures how relevant your ads, keywords, and landing pages are to user searches. The Brand Keywords - Core ad group with a Quality Score of 9 (green indicator) enjoys lower CPCs and better ad positions because the platform rewards relevance. Meanwhile, Competitor Terms - Brand B with a Quality Score of 4 (red indicator) faces higher costs and worse positioning. A professional performance marketer obsesses over Quality Score because improving it from 5 to 7 can reduce your CPC by 30-40% while maintaining the same ad position. You’d investigate low Quality Score ad groups by examining expected click-through rate, ad relevance, and landing page experience the three components that determine this score.

Default Max CPC and Bidding Strategy

The Default max. CPC column shows your maximum cost-per-click bid for each ad group. Brand Keywords - Core at $0.75 reflects aggressive bidding on high-value branded terms where you want dominant visibility. Product - Category B at $0.48 suggests moderate competition for product-specific searches. The “Auto” designation on Premium Products and Budget Products indicates automated bidding strategies where the platform adjusts bids dynamically to meet your conversion goals. As a performance marketer, you’d choose manual CPC bidding when you want precise control and have sufficient conversion data, or automated bidding (Target CPA, Target ROAS, Maximize Conversions) when you want the algorithm to optimize based on your goals. The small wrench icon next to manual bids suggests you can quickly adjust them based on performance if an ad group is converting well below your target CPA, you’d increase the max CPC to capture more volume.

Performance Metrics Analysis

The Clicks, Impressions, and CTR columns reveal engagement patterns. Brand Keywords - Core with 2,891 clicks and 47,234 impressions achieves a strong 6.12% CTR, indicating highly relevant targeting users searching for your brand terms are clicking enthusiastically. Compare this to Competitor Terms - Brand B with only 58 clicks from 1,795 impressions (3.23% CTR), showing that bidding on competitor terms yields lower engagement. The Avg. CPC column shows actual costs paid, not just maximum bids Brand Keywords - Core at $0.42 actual CPC versus $0.75 max CPC means you’re winning auctions at lower prices due to high Quality Score. This is the power of relevance: you bid $0.75 but only pay $0.42 because your ad quality is superior to competitors.

Cost and Conversion Economics

The Cost column shows total spend per ad group, while Conversions and Conv. rate tell the conversion story. Brand Keywords - Core has spent $1,234.22 generating 78 conversions at a 2.70% conversion rate, giving you a cost per conversion of about $15.82 (calculated by dividing $1,234.22 by 78). High Intent - Purchase Terms has spent $357.86 generating 31 conversions at 2.51% conversion rate, yielding roughly $11.54 per conversion this is one of your most efficient ad groups and deserves budget increases. Meanwhile, Competitor Terms - Brand B has zero conversions from $36.54 spend, making it a clear candidate for pausing or complete restructuring. The Budget Products ad group with only 4 conversions from $99.75 spend ($24.94 CPA) is underperforming and needs investigation into whether the product margins justify this acquisition cost.

Status Indicators and Strategic Signals

The Status column shows Active, Limited, or Paused states. The Premium Products ad group with “Limited” status (yellow indicator) means it’s not spending its full budget potential, typically due to low search volume, restrictive targeting, or bid levels too low to compete in auctions. A performance marketer would investigate whether loosening match types, expanding keywords, or increasing bids could unlock more volume. The Paused status on Competitor Terms - Brand A and Brand B suggests previous poor performance led to their deactivation the data confirms this with weak conversion rates and high CPAs. However, competitor bidding is often a strategic necessity for market share defense, so you might test reactivating these with refined negative keywords, better ad copy, or adjusted bids rather than abandoning the strategy entirely.

Ad Group Architecture and Organization

Notice how ad groups are organized by intent level and campaign type. “Brand Keywords - Core” and “Brand Keywords - Variations” separate exact brand matches from broader brand queries, allowing different bidding strategies and ad copy for each. “Product - Category A” and “Product - Category B” segment different product lines, enabling category-specific messaging and budget allocation based on profitability. “High Intent - Purchase Terms” likely contains bottom-funnel keywords like “buy,” “discount,” or “deal” that signal immediate purchase intent and justify higher bids. “General Awareness” contains top-funnel terms for users early in their journey, explaining its lower conversion rate (1.51%) but potentially valuable role in assisted conversions. This thoughtful architecture allows surgical optimization you can adjust bids, budgets, and creative at the precise level of user intent rather than treating all traffic equally.

Video Ad Group Performance

The Tutorial Videos and Brand Story ad groups, both marked as Video - Product Demo, show the challenge of measuring video campaign effectiveness. Tutorial Videos has 3 conversions from $44.46 spend (1.28% conversion rate), while Brand Story has only 1 conversion from $26.24 (0.61% conversion rate). Video campaigns typically have lower direct conversion rates because they serve awareness and consideration functions, with users converting later through other touchpoints. A sophisticated performance marketer would set up view-through conversion tracking to measure users who saw the video but converted within 30 days through other channels, and would evaluate video campaigns using assisted conversion metrics rather than just last-click attribution.

Optimization Priority Framework

Using this dashboard, you’d prioritize optimization in tiers. Tier 1 (scale winners): Increase budgets and bids on High Intent - Purchase Terms, General Awareness, and both Brand Keywords ad groups that are performing efficiently. Tier 2 (fix or kill): Investigate Premium Products’ “Limited” status to unlock more volume, analyze Budget Products’ high CPA to determine if product economics support continued spend, and decide whether to restructure or permanently pause both Competitor Terms ad groups. Tier 3 (improve quality): Work on improving Quality Scores for Product - Category B (score of 7) and Product - Category A (score of 6) by testing new ad copy, refining keyword match types, or improving landing page relevance. Tier 4 (test and learn): Let video ad groups accumulate more data before making major changes, monitor the Shopping ad groups’ automated bidding performance, and consider expanding keyword lists in high-performing ad groups to capture more volume at similar efficiency.

Advanced Metrics and Hidden Insights

The sortable column headers (indicated by small arrows) allow you to rank ad groups by any metric to quickly identify outliers. Sorting by Conv. rate descending would reveal your highest-converting ad groups that might be underfunded. Sorting by Avg. CPC ascending shows your most cost-efficient traffic sources. Sorting by Impressions descending reveals which ad groups have the most visibility regardless of performance. The Columns dropdown button lets you add additional metrics like Search Impression Share (how often your ads show versus total available impressions), Average Position, or conversion value data if you’re tracking revenue. The Filter button enables sophisticated segmentation you could filter to show only ad groups with Quality Score below 6, or only remarketing ad groups, or only ad groups with conversion rates above 3%. This data manipulation capability becomes essential as you scale to hundreds of ad groups.

The Relationship to Campaign Structure

Each ad group is nested within one of the campaigns you saw in the previous view. Brand Keywords - Core and Brand Keywords - Variations both belong to the Brand Search Campaign, explaining that campaign’s strong $150 daily budget and 124 total conversions. Premium Products and Budget Products belong to the Shopping - All Products campaign, revealing why that campaign has lower conversion volume its component ad groups aren’t scaling efficiently. Understanding this hierarchical relationship (Account → Campaign → Ad Group → Keywords/Audiences → Ads) is fundamental to performance marketing structure. You set budgets and campaign-level settings at the campaign level, but you control the actual targeting, bidding, and creative strategy at the ad group level, making this view the true optimization workhorse of your account.

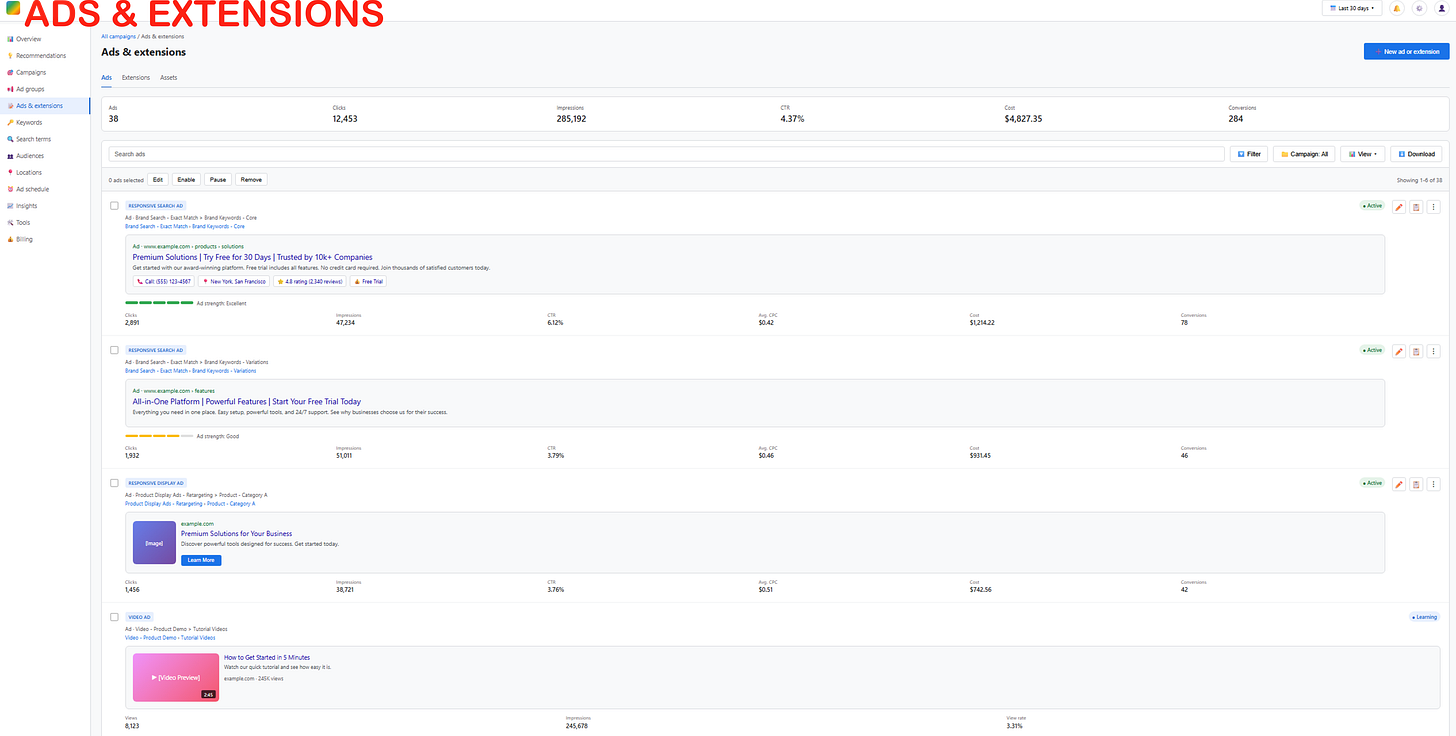

ADS & EXENTIONS

The Ads & Extensions view is where creative execution meets performance data this is the granular level where you can see exactly which ad variations are resonating with audiences and driving conversions. For a professional performance marketer, this view is essential for understanding message-market fit and continuously improving ad effectiveness through testing and optimization.

The Strategic Role of Ads

While campaigns control budget and ad groups control targeting, individual ads are where you communicate your value proposition to potential customers. The 38 ads shown here represent different creative approaches, headlines, descriptions, and calls-to-action being tested across your ad groups. Each ad competes in real-time auctions, and the platform uses performance data to automatically serve your best-performing ads more frequently. Understanding which specific messages, offers, and creative elements drive results allows you to systematically improve your advertising effectiveness over time.

Summary Performance Metrics

The top banner shows aggregate performance across all 38 ads: 12,453 clicks, 285,192 impressions, a 4.37% CTR, $4,827.35 in cost, and 284 conversions. The 4.37% overall CTR is a strong engagement rate, suggesting your ad creative is generally resonating well with your target audiences. However, this aggregate number masks significant variation some ads will be performing at 6-8% CTR while others languish below 2%. Your job as a performance marketer is to identify these patterns and systematically replace underperformers with variations that test new hypotheses about what messages resonate.

Ad Preview and Hierarchy

Each ad card shows the complete ad experience exactly as users see it. The first ad “RESPONSIVE SEARCH AD” for the Brand Search ad group displays the website URL (www. example . com - products - solutions), the headline “Premium Solutions | Try Free for 30 Days | Trusted by 104+ Companies,” the description copy emphasizing the free trial and award-winning platform, and additional elements like phone extensions (Call: 855-123-4567), location extensions (New York, San Francisco), sitelink extensions showing a 4.8-star rating, and a free trial callout. This comprehensive view allows you to evaluate whether all elements work together cohesively to drive the desired action. Notice the breadcrumb trail at the top showing “Ad : Brand Search : Exact Match : Brand Keywords : Core” and the matching “Brand Search : Exact Match : Brand Keywords : Core” below this hierarchical path shows exactly where this ad lives within your account structure.

Responsive Search Ads vs Traditional Ads

The “RESPONSIVE SEARCH AD” designation indicates this is Google’s AI-powered ad format where you provide multiple headline and description options, and the platform automatically tests combinations to find the best performers. This is the current best practice format because it allows the algorithm to personalize ad copy based on user context, device, and search query. The green “Ad strength: Excellent” indicator means you’ve provided sufficient headline and description variations with good diversity for the algorithm to optimize effectively. A professional performance marketer would ensure all responsive search ads achieve “Excellent” ad strength by providing 10-15 unique headlines and 3-4 unique descriptions that emphasize different value propositions, features, and benefits.

Performance Metrics Per Ad

Below each ad preview, you see granular performance data. The first ad has 2,891 clicks from 47,234 impressions (6.12% CTR), spent $1,234.22 at an average CPC of $0.42, and generated 78 conversions. The second ad has 1,932 clicks from 51,011 impressions (3.79% CTR), spent $931.45 at $0.46 CPC, and generated 46 conversions. Comparing these two ads within the same ad group reveals important insights: the first ad has a significantly higher CTR (6.12% vs 3.79%), suggesting its messaging resonates better with users searching brand terms. However, both ads are running, which means you’re using ad rotation settings that test multiple variations rather than optimizing solely for clicks. As a performance marketer, you’d calculate conversion rates for each ad the first ad converts at 2.70% (78 conversions / 2,891 clicks) while the second converts at 2.38% (46/1,932) and evaluate whether the CTR difference translates to meaningful conversion rate improvements.

Ad Extensions Impact

The extensions visible in the ads (phone numbers, locations, sitelinks, ratings, callouts) are critical for improving ad performance. Extensions increase your ad’s real estate on the search results page, making it more prominent and clickable. They also provide additional pathways for users to engage some users prefer calling directly, others want to see your physical locations, and sitelinks allow navigation to specific pages. The “Call: 855-123-4567” extension with its phone icon is particularly valuable for businesses where phone conversions are important. The “4.8 rating (2,487 reviews)” extension builds trust and social proof. The “Free Trial” callout creates urgency and lowers barriers to entry. A professional performance marketer would analyze extension performance separately to understand which extensions drive incremental clicks and conversions, then ensure high-performing extensions are deployed consistently across all relevant campaigns.

Creative Testing Insights

The third ad for “RESPONSIVE SEARCH AD” in the Product Display Ads ad group shows different messaging: “Premium Solutions for Your Business” with a “Discover powerful tools designed for success. Get started today” description and a “Learn More” call-to-action button. This ad’s performance 1,456 clicks from 38,721 impressions (3.76% CTR), 42 conversions reveals that display/remarketing ads naturally have lower engagement rates than search ads, but that’s expected given the different user context. The visual creative shown (a purple image with “iTarget” branding) adds another testing variable. A performance marketer would test different image variations, headline emphasis (benefit-driven vs. feature-driven), and CTA copy (Learn More vs. Shop Now vs. Get Started) to systematically improve performance.

Video Ad Creative

The fourth ad shows a video format with a thumbnail featuring a pink-to-purple gradient and “Vision Promo” text. The headline “How to Get Started in 3 Minutes” with tutorial copy suggests educational content designed to reduce adoption barriers. Video ads serve different objectives than text or image ads they’re primarily for building awareness, demonstrating product functionality, or establishing emotional connections. The fact that this ad has generated 8,123 views is notable, but views alone don’t indicate success. A professional performance marketer would measure video completion rates (what percentage watch to 25%, 50%, 75%, 100%), view-through conversions (users who saw the video but converted later), and engagement metrics like clicks to website or channel subscriptions to evaluate video effectiveness beyond just the 241,878 impressions shown.

Ad Status and Management

The green “Active” indicator next to each ad means they’re currently eligible to serve in auctions. The edit (pencil) icon allows quick modifications to ad copy without rebuilding from scratch, which is valuable when you need to update pricing, offers, or seasonal messaging quickly. The duplicate icon lets you create variations to test different hypotheses you might duplicate an ad and change only the headline to isolate what drives performance differences. The three-dot menu provides access to advanced options like pausing specific ads, viewing detailed statistics, or accessing the ad preview and diagnosis tool to see exactly when and how your ads appear in searches.

Ad Strength and Quality Indicators

The colored bars next to “Ad strength: Excellent” and “Ad strength: Good” use Google’s machine learning to evaluate ad quality based on factors like headline diversity, description length, keyword inclusion, and uniqueness. “Excellent” ads leverage the full power of responsive search ads with sufficient variation for meaningful testing. “Good” ads work but have room for improvement perhaps adding more headline options or making existing headlines more distinct from each other. “Poor” ads (not shown here but possible) would need immediate attention, as they limit the algorithm’s ability to optimize and may result in lower Quality Scores. A professional performance marketer regularly audits ad strength across the account and systematically improves any ads below “Excellent” status.

The Testing Philosophy

Professional performance marketers approach this view with a hypothesis-driven testing mindset. You’re not randomly creating ads and hoping for the best you’re testing specific hypotheses about what resonates with your audience. For example, you might test whether emphasizing the “30-day free trial” in headlines outperforms emphasizing “104+ companies trust us.” You might test whether problem-focused messaging (”Frustrated with slow tools?”) converts better than solution-focused messaging (”Fast, powerful tools for success”). You might test whether including price in ad copy improves conversion quality even if it reduces CTR. Each ad variation represents a specific bet about customer psychology, and the performance data tells you which bets paid off.

Optimization Decision Framework

Using this view, you’d make several types of optimization decisions. First, identify and pause underperforming ads that have sufficient data (typically 100+ clicks or 1,000+ impressions) but show CTRs below 50% of your best performers or conversion rates significantly worse than alternatives. Second, create new ad variations testing winning hypotheses from other ad groups if emphasizing “free trial” works well in one ad group, test it in others. Third, ensure all ads have “Excellent” ad strength by adding more headline and description variations. Fourth, review extension performance and add missing extensions that competitors are using. Fifth, analyze the messaging in your top-performing ads to identify patterns are customers responding to price, features, trust signals, urgency, or something else? then double down on those themes across your entire account.

The Connection to Conversion Quality

Beyond just conversion volume, professional performance marketers evaluate conversion quality at the ad level. Some ads might drive high click-through rates but attract low-intent users who convert at poor rates or have low lifetime value. Other ads might have moderate CTRs but attract highly qualified users who become valuable customers. If your platform is connected to CRM or revenue tracking, you’d evaluate ads based on revenue per click or customer lifetime value, not just conversion rate. This might reveal that an ad emphasizing premium features drives fewer conversions but much higher revenue per conversion, making it more valuable despite appearing less successful in basic metrics.

Continuous Improvement Process

The Ads & Extensions view represents your creative laboratory where continuous improvement happens through systematic testing and iteration. Professional performance marketers establish a regular cadence weekly or bi-weekly to review ad performance, pause clear losers, launch new tests, and scale winning creative approaches. Over time, this disciplined process compounds, with each testing cycle incrementally improving your average CTR, conversion rate, and cost per acquisition. The accounts that outperform competitors aren’t necessarily the ones with bigger budgets or better products they’re the ones with better creative testing discipline, faster learning cycles, and more rigorous application of insights from this exact view. Mastering this view transforms advertising from a cost center into a scalable, predictable growth engine where every dollar spent generates measurable learning and improvement.

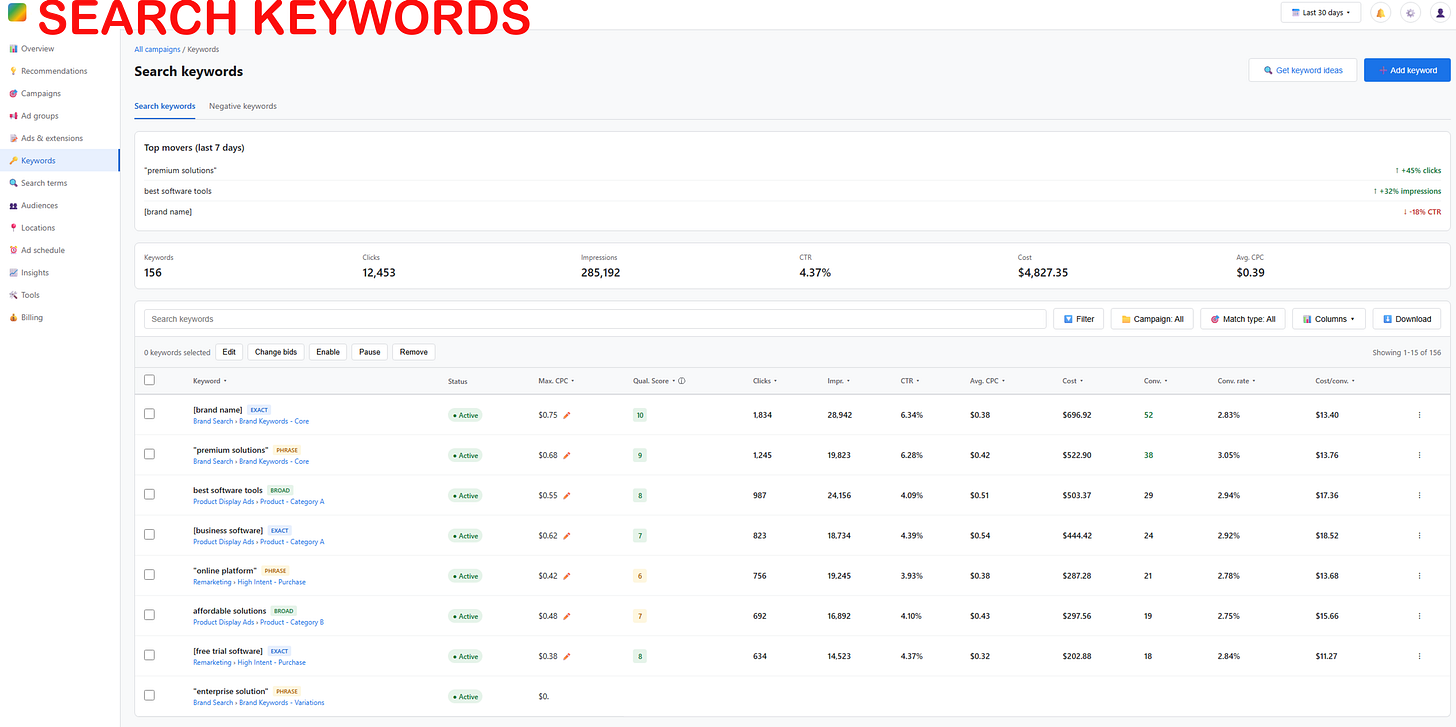

SEARCH KEYWORDS

The Search Keywords view is the foundation of search advertising success this is where you control which user searches trigger your ads, manage your bids at the most granular level, and identify opportunities to expand or refine your targeting. For professional performance marketers, keyword management is both an art and a science, requiring deep understanding of search intent, competitive dynamics, and the economics of customer acquisition.

The Strategic Importance of Keywords

Keywords are the literal connection between what users search for and when your ads appear. The 156 keywords shown here represent your current targeting strategy across all campaigns and ad groups. Each keyword is a bet about what terms indicate purchase intent or interest in your products. The quality of your keyword selection directly determines whether you’re reaching the right audiences at the right time in their buying journey. Poor keyword strategy means wasted spend on irrelevant clicks, while excellent keyword strategy means efficiently capturing high-intent users who are actively looking for what you offer.

Top Movers Analysis

The “Top movers (last 7 days)” section at the top provides immediate visibility into emerging trends. “Premium solutions” with +45% clicks indicates this keyword is gaining momentum perhaps due to seasonal factors, competitive changes, or improved ad position. “Best software tools” with +32% impressions shows expanding visibility, possibly from bid increases or Quality Score improvements. “[Brand name]” with -18% CTR is concerning your branded terms should maintain high CTRs, so a decline suggests either ad copy problems, new competitor activity on your brand terms, or search result page changes. A professional performance marketer monitors these movers daily to catch opportunities (scale winners) and problems (fix decliners) before they significantly impact performance.

Aggregate Performance Metrics

The summary shows 156 keywords driving 12,453 clicks from 285,192 impressions (4.37% CTR overall) at $4,827.35 cost and $0.39 average CPC. This $0.39 average CPC is your blended efficiency benchmark across all keywords. However, this average masks tremendous variation some keywords cost $0.32 per click while others cost $0.75. Understanding this distribution helps you identify where competitive pressure is highest and where you’re finding bargain traffic. The 4.37% overall CTR is solid, indicating reasonable relevance between your keywords, ads, and user search queries.

Keyword Match Types

Each keyword has match type indicators showing how broadly or narrowly it targets searches. “[brand name]” with an EXACT tag (shown in brackets) means your ad only shows for that precise term with no variations this is your most controlled, highest-intent targeting. “Premium solutions” with a PHRASE tag (shown in quotes) means your ad shows when that exact phrase appears in the search, but other words can come before or after like “affordable premium solutions” or “premium solutions for small business.” “Best software tools” with a BROAD tag means your ad can show for related variations, synonyms, and loosely related searches maximum reach but less control over relevance. Professional performance marketers use match type strategy intentionally: exact match for proven high-performers where you want maximum control and visibility, phrase match for scaling beyond exact while maintaining some relevance control, and broad match (cautiously) for discovery of new keyword opportunities you haven’t considered.

Quality Score and Bidding Intelligence

The Qual. Score column reveals the platform’s assessment of keyword relevance. “[Brand name]” with a Quality Score of 10 (green circle) is perfect your ads, keywords, and landing pages are perfectly aligned for branded searches, resulting in lower costs and better positions. “Premium solutions” with a Quality Score of 9 is excellent, indicating strong relevance. “Online platform” with a Quality Score of 6 (yellow circle) shows room for improvement you might need better ad copy specifically mentioning “online platform,” or a dedicated landing page that emphasizes platform features. “Affordable solutions” with a Quality Score of 7 suggests decent but improvable relevance. Quality Score directly impacts your costs improving from 6 to 8 can reduce your CPC by 25-30% while maintaining position, making it one of the highest-leverage optimization activities.

Max CPC and Bidding Strategy

The Max. CPC column shows your maximum bid for each keyword. “[Brand name]” at $0.75 reflects aggressive bidding to dominate branded search results where conversion rates are typically highest. “Premium solutions” at $0.68, “[business software]” at $0.62, and “online platform” at $0.42 show tiered bidding based on expected value. The small pencil icon next to each bid allows quick adjustments if a keyword is converting profitably below your target CPA, you’d increase the bid to capture more volume; if it’s above target CPA, you’d decrease to improve efficiency or pause entirely. Professional performance marketers adjust bids continuously based on performance data, competitive dynamics, and business objectives. The fact that “enterprise solution” shows $0.__ (blank) with a pencil icon suggests it may be using inherited ad group bidding or needs bid assignment.

Performance Metrics Deep Dive

The Clicks, Impressions, and CTR columns tell your engagement story at the keyword level. “[Brand name]” with 1,834 clicks from 28,942 impressions (6.34% CTR) shows strong brand recognition and ad relevance. “Premium solutions” with 1,245 clicks from 19,823 impressions (6.28% CTR) performs nearly as well, suggesting this non-branded term is highly relevant to your offering. “Best software tools” with 987 clicks from 24,156 impressions (4.09% CTR) shows decent but not exceptional engagement this broader term attracts more varied user intent, resulting in lower CTR. “[Business software]” with 823 clicks from 18,734 impressions (4.39% CTR) performs reasonably well for a category term. Lower CTRs on broader keywords are expected, but if a keyword’s CTR falls below 2%, it signals poor relevance and likely low Quality Score, resulting in higher costs and worse positions.

Cost Analysis and CPA Economics

The Avg. CPC, Cost, Conv., and Conv. rate columns reveal the complete economic picture. “[Brand name]” has a $0.38 average CPC (well below the $0.75 max bid due to Quality Score 10), has spent $696.92, and generated 52 conversions at 2.83% conversion rate, yielding approximately $13.40 cost per conversion. This is highly efficient. “Premium solutions” at $0.42 average CPC, $522.90 cost, and 38 conversions (3.05% conversion rate) yields roughly $13.76 CPA also excellent performance. “Best software tools” at $0.51 average CPC, $503.37 cost, and 29 conversions (2.94% conversion rate) yields about $17.36 CPA still profitable but less efficient than top performers. “[Free trial software]” at $0.32 average CPC, $202.88 cost, and 18 conversions (2.84% conversion rate) yields $11.27 CPA your most efficient keyword, suggesting “free trial” intent signals high conversion probability and deserves budget expansion.

Conversion Rate Patterns

The Conv. rate column reveals which keywords attract high-quality traffic. “Premium solutions” at 3.05% conversion rate is your best performer, suggesting users searching this term have strong purchase intent and good product fit. “Best software tools” at 2.94%, “[business software]” at 2.92%, and “[free trial software]” at 2.84% all cluster around 2.8-3%, indicating solid keyword quality. “Online platform” at 2.78% is slightly lower, while “affordable solutions” at 2.75% shows that price-focused searchers may be less likely to convert or may be earlier in their buying journey. Professional performance marketers don’t just chase high-volume keywords they prioritize keywords with strong conversion rates because attracting 1,000 low-intent visitors who don’t convert is far worse than attracting 100 high-intent visitors who convert at 5%.

Cost Per Conversion Optimization

The Cost/conv. column is arguably the most important for profitability decisions. “[Free trial software]” at $11.27 is your champion it’s efficiently attracting and converting users at the lowest cost. “[Brand name]” at $13.40 and “premium solutions” at $13.76 are also highly efficient. “Best software tools” at $17.36, “[business software]” at $18.52, and “affordable solutions” at $15.66 are more expensive but may still be profitable depending on your customer lifetime value. “Online platform” at $13.68 looks efficient superficially, but with only 21 conversions, you’d want more data before making major decisions. If your average customer lifetime value is $200 and you target a 5:1 LTV:CAC ratio, then you’d want CPAs below $40, meaning all these keywords are profitable but you’d allocate more budget to the most efficient ones first.

The Negative Keywords Strategy

The “Negative keywords” tab next to “Search keywords” is equally important as the keywords themselves. Negative keywords prevent your ads from showing on irrelevant searches, saving budget for qualified traffic. If you’re selling premium software but your ads show for “free software download” searches, you’re wasting money on users who won’t convert. Professional performance marketers regularly review search term reports (which show actual user queries that triggered ads, not just your keywords) to identify irrelevant terms and add them as negatives. Common negative keyword categories include: competitor brands (if you don’t want to bid on them), price-sensitive terms (”cheap,” “free” when selling premium), job-seeking terms (”software developer jobs”), and informational queries (”what is software”).

Keyword Expansion Opportunities

The “Get keyword ideas” button in the top right opens research tools to discover new keyword opportunities based on your existing keywords, landing pages, or competitor domains. Professional performance marketers continuously expand their keyword lists by identifying: close variations of successful keywords (if “premium solutions” works well, test “premium software,” “premium tools,” “premium platform”), long-tail variations that indicate specific intent (”premium solutions for healthcare,” “premium solutions small business”), question-based keywords that signal research intent (”what are the best premium solutions,” “how to choose premium software”), and comparison keywords that indicate active evaluation (”premium solutions vs [competitor],” “premium solutions review”).

Bulk Management Tools

The Edit, Change bids, Enable, Pause, and Remove buttons allow efficient management of multiple keywords simultaneously. If you identify five keywords all performing at similar efficiency, you could select them all and increase bids by 20% in one action rather than editing individually. If you find several keywords with Quality Scores below 5 and poor conversion rates, you could pause them all at once. The Filter button lets you segment keywords by performance thresholds show only keywords with CTR above 5%, or conversion rate above 3%, or CPA below $15 making it easy to identify optimization opportunities across large keyword portfolios.

Campaign and Match Type Context

The breadcrumb trail under each keyword (like “Brand Search > Brand Keywords > Core” for “[brand name]”) shows exactly where it lives in your account hierarchy, allowing you to understand how campaign and ad group structure affects performance. Notice that the same keyword might appear multiple times in different match types or ad groups “[brand name]” as exact match in Brand Search, and potentially as phrase or broad match elsewhere. This intentional redundancy allows testing different bidding strategies and ad copy approaches for the same user intent. However, too much overlap can cause your own ads to compete against each other, so professional performance marketers carefully manage keyword distribution across ad groups to avoid cannibalization.

The Status and Health Indicators

All visible keywords show green “Active” status, meaning they’re eligible to serve. However, keywords can also show “Paused” (intentionally stopped), “Low search volume” (not showing because few people search it), or “Below first page bid” (your bid is too low to appear on the first page of results). The pencil icons next to Max CPC bids indicate you can quickly adjust bids. The colored Quality Score indicators (green for 8-10, yellow for 5-7, red for 1-4) provide at-a-glance health assessment. A professional performance marketer maintains a dashboard of keyword health metrics and systematically addresses any keywords showing warning signs before they become major performance drags.

Advanced Optimization Framework

Using this view, professional performance marketers implement a continuous optimization cycle. Weekly tasks include: reviewing top movers to understand trend drivers, adjusting bids on proven performers to maximize efficient volume, pausing or lowering bids on keywords exceeding CPA targets, reviewing search term reports to identify negative keywords and new keyword opportunities, and ensuring Quality Scores remain high by improving ad relevance for any keywords scoring below 7. Monthly tasks include: comprehensive keyword portfolio analysis to identify which categories (branded, category, competitor, product-specific, solution-oriented) drive best ROI, testing new keyword themes based on product launches or market changes, conducting competitive keyword research to identify gaps in current coverage, and analyzing keyword performance by device, location, and time to identify more granular optimization opportunities. The accounts that achieve sustainable competitive advantage aren’t those with the biggest budgets they’re those with the most sophisticated keyword strategy, executed with discipline through this exact view.

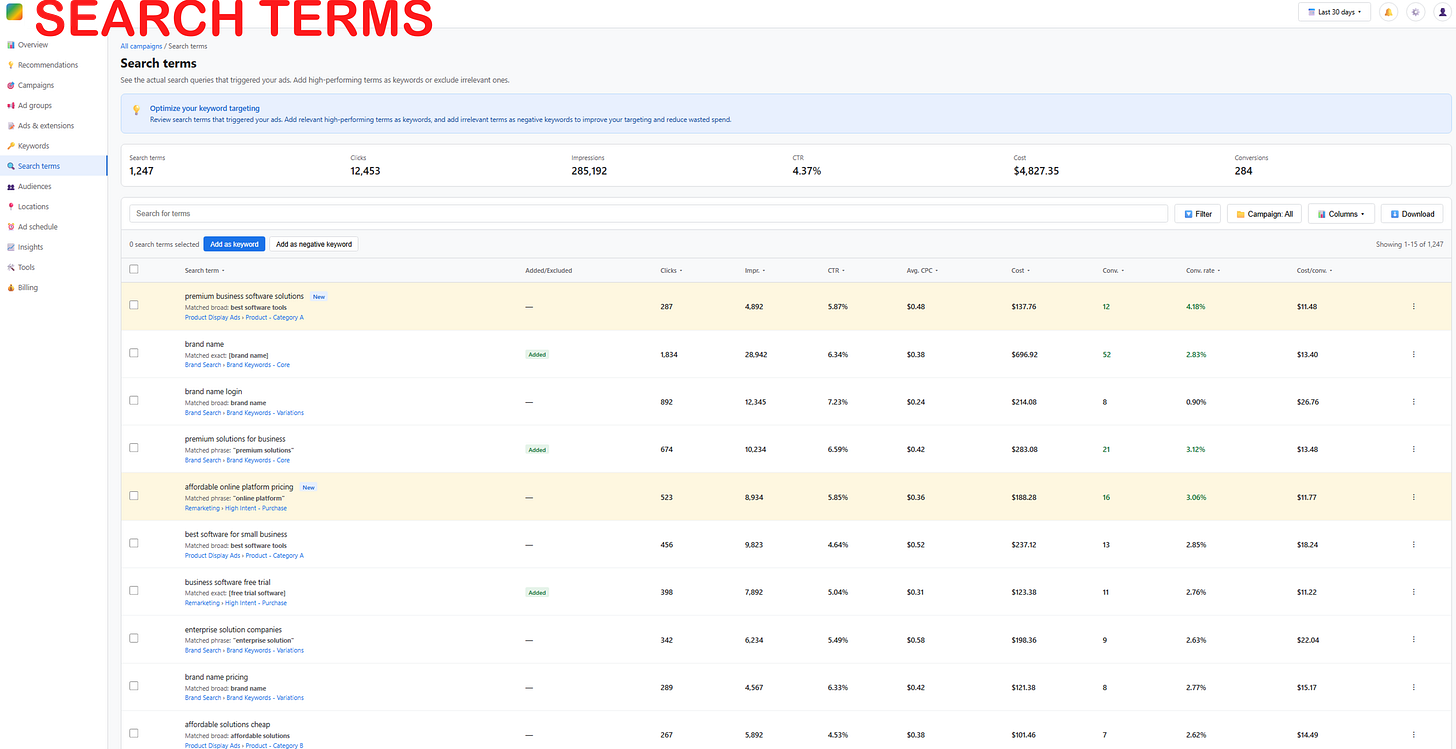

SEARCH TERMS

The Search Terms view is the intelligence goldmine of search advertising this is where you see the actual queries users typed into search engines that triggered your ads, revealing the gap between your keyword targeting intentions and real-world user behavior. Professional performance marketers spend significant time in this view because it’s where you discover high-performing keywords you hadn’t considered, identify wasteful spending on irrelevant searches, and continuously refine your targeting to maximize ROI.

The Critical Difference: Keywords vs. Search Terms

Understanding the distinction between keywords and search terms is fundamental to search advertising mastery. Keywords (from the previous view) are what you bid on and tell the platform when to show your ads. Search terms are what users actually type into search engines. Because of match types (especially phrase and broad match), a single keyword can trigger your ads for dozens or hundreds of different search terms. For example, your broad match keyword “premium solutions” might trigger ads for “premium business software solutions,” “affordable premium solutions,” “premium solutions review,” or even loosely related terms like “premium consulting services.” This view reveals those actual searches, allowing you to identify which variations are valuable and which are wasting budget.

Summary Performance Overview

The top banner shows 1,247 unique search terms drove 12,453 clicks from 285,192 impressions (4.37% CTR) at $4,827.35 cost and 284 conversions. The fact that 156 keywords (from the previous view) expanded into 1,247 search terms shows how match types broaden your reach each keyword is capturing multiple search variations. This expansion is both an opportunity and a risk: opportunity because you’re discovering relevant searches you hadn’t explicitly targeted, and risk because you’re likely also matching to some irrelevant searches that waste budget. Your job is to systematically sort the valuable from the wasteful.

The Optimization Guidance

The yellow highlighted box at the top provides actionable intelligence: “Optimize your keyword targeting. Review search terms that triggered your ads. Add high-performing terms as keywords, and add irrelevant terms as negative keywords to improve your targeting and reduce wasted spend.” This is the fundamental workflow professional performance marketers follow weekly: review search terms data, promote winners by adding them as exact match keywords with appropriate bids, block losers by adding them as negative keywords, and continuously tighten the alignment between what you’re paying for and what actually drives results.

New Discovery Opportunities

The first row “premium business software solutions” with a “New” tag and yellow highlight indicates this is a recently discovered search term that hasn’t yet been evaluated. With 287 clicks from 4,892 impressions (5.87% CTR), 12 conversions at 4.18% conversion rate, and $11.48 cost per conversion, this is clearly a high-performer. The fact that it shows “Matched broad: best software tools” and appears under “Product Display Ads > Product > Category A” tells you this search term was triggered by your broad match keyword “best software tools.” A professional performance marketer would immediately add “premium business software solutions” as an exact match keyword in the appropriate ad group with a specific bid, rather than letting it continue matching through broad match where you have less control. This single search term represents a specific user intent that’s proven to convert efficiently capturing it explicitly ensures you maintain visibility and control costs.

Brand Search Terms Analysis

The second row shows “brand name” (representing your actual brand) as a matched exact keyword with “Added” status (green indicator). With 1,834 clicks from 28,942 impressions (6.34% CTR), 52 conversions at 2.83% conversion rate, and $13.40 CPA, this branded search performs exactly as expected high engagement, strong conversion, efficient cost. The “Brand Search > Brand Keywords > Core” breadcrumb shows this is already captured in your brand campaign. Brand terms should always be in your keyword list as exact match to ensure you control your brand’s search presence and prevent competitors from stealing your traffic.

Brand Variation Discoveries

The third row “brand name login” shows users searching for your login page. With 892 clicks from 12,345 impressions (7.23% CTR), 8 conversions at 0.90% conversion rate, and $26.76 CPA, this search term reveals important user behavior. The low conversion rate and high CPA suggest these are existing customers looking for the login page, not new prospects. A sophisticated marketer would handle this several ways: create a dedicated ad specifically for login-intent searches with ad copy like “Existing Customer? Sign In Here” and a sitelink directly to the login page, potentially use lower bids since these aren’t new customer acquisitions, or consider whether you should advertise on login terms at all since these users are already customers and you’re essentially paying to send them to a page they could find organically.

Close Variation Performance

The fourth row “premium solutions for business” shows “Added” status, meaning it’s been promoted from search term to keyword. With 674 clicks from 10,234 impressions (6.59% CTR), 21 conversions at 3.12% conversion rate, and $13.48 CPA, this variation of your core “premium solutions” keyword performs similarly well. This demonstrates why reviewing search terms is valuable you discover that users don’t just search your exact keywords, they add qualifying words like “for business,” “for small business,” “for enterprises,” each representing slightly different user intent that you can target specifically.

New Discovery with Purchase Intent

The fifth row “affordable online platform pricing” with a “New” tag shows 523 clicks from 8,934 impressions (5.85% CTR), 16 conversions at 3.06% conversion rate, and $11.77 CPA. This search term is particularly valuable because it includes “pricing,” which is a strong buying signal users researching pricing are typically late in their purchase journey. The word “affordable” might concern some marketers who position themselves as premium, but the strong conversion rate and low CPA suggest these users are qualified buyers, not just bargain hunters. The fact it matched through “online platform” under “Remarketing > High Intent > Purchase” shows your broad match strategy is working to capture purchase-intent variations. You’d add this as an exact match keyword and potentially create dedicated ad copy emphasizing your competitive pricing or value proposition.

Category Search Terms

The sixth row “best software for small business” matched your “best software tools” keyword, generating 456 clicks from 9,823 impressions (4.64% CTR), 13 conversions at 2.85% conversion rate, and $18.24 CPA. This reveals that small business users are finding you through category searches. The slightly higher CPA suggests this may be a more competitive or lower-value segment, but it’s still profitable. You’d evaluate whether to create a dedicated small business campaign with tailored messaging, or whether to add this as a phrase match keyword with slightly lower bids given the higher CPA.

Free Trial Intent Signals

The seventh row “business software free trial” shows “Added” status with 398 clicks from 7,892 impressions (5.04% CTR), 11 conversions at 2.76% conversion rate, and $11.22 CPA. This is another high-value search term because “free trial” indicates users ready to take action, not just research. The strong performance validates your free trial offer as a conversion driver. You’d ensure your ad copy prominently features the free trial offer, your landing page makes sign-up frictionless, and your bid is competitive since these users have high conversion probability.

Competitor Comparison Searches

The eighth row “enterprise solution companies” shows 342 clicks from 6,234 impressions (5.49% CTR), 9 conversions at 2.63% conversion rate, and $22.04 CPA. The higher CPA reflects that users comparing multiple enterprise vendors are sophisticated buyers conducting extensive research. While more expensive to acquire, enterprise customers typically have much higher lifetime value, potentially making this $22.04 CPA highly profitable if your average enterprise deal is worth $50,000+. You’d maintain presence on these comparison terms but might adjust bids based on actual customer value data.

Brand-Related Price Searches

The ninth row “brand name pricing” with 289 clicks from 4,567 impressions (6.33% CTR), 8 conversions at 2.77% conversion rate, and $15.17 CPA shows existing awareness users researching your pricing. These are warm leads who know your brand and are evaluating cost essentially late-stage prospects. The solid performance justifies bidding on these terms, though you’d ensure your ads and landing pages address pricing transparently since that’s the user’s primary question.

Low-Intent Modifier Detection

The tenth row “affordable solutions cheap” shows 267 clicks from 5,892 impressions (4.53% CTR), 7 conversions at 2.62% conversion rate, and $14.49 CPA. The word “cheap” is often a red flag indicating price-sensitive users who may not be good fits for premium products. However, the decent conversion rate suggests these users are still qualifying. You’d monitor customer lifetime value data if users acquired through “cheap” searches have significantly lower retention or higher churn, you might add “cheap” as a negative keyword across campaigns. If they convert to quality customers, the search term stays.

The Added vs. New Status Indicators

Search terms marked “Added” (green) have been promoted to keywords, meaning you’ve explicitly added them to your keyword lists for better control and specific bidding. Search terms with “New” (blue) are recently discovered and awaiting evaluation. Search terms with no status indicator (showing “ “) are being monitored but haven’t yet been acted upon. Professional performance marketers establish a regular review cadence weekly or bi-weekly to evaluate new search terms and make add/negative decisions based on sufficient data. Generally, you’d wait until a search term has at least 30-50 clicks or 1,000 impressions before making decisions, as small sample sizes can be misleading.

The Add as Keyword Workflow

The “Add as keyword” button at the top allows bulk promotion of high-performers. You’d select multiple valuable search terms (checking the boxes on the left), click “Add as keyword,” choose which ad groups to add them to, set match types (typically exact match for proven performers), and set initial bids based on their current CPA performance. This systematic promotion of winners is how you build keyword lists from real performance data rather than just guessing what might work.

The Add as Negative Keyword Workflow

The “Add as negative keyword” button is equally important for eliminating waste. As you scroll through 1,247 search terms, you’d identify irrelevant ones perhaps “free software download” if you don’t offer free products, “software developer jobs” if you’re selling software not hiring, or “[competitor name]” if you don’t want to bid on competitors. You’d select these wasteful terms and add them as negative keywords at the campaign or account level, preventing future ad triggers on these searches and saving budget for relevant traffic.

Statistical Significance Considerations

Looking at the conversion data, some search terms have substantial volume (52 conversions for “brand name”) while others have limited data (7-8 conversions). Professional performance marketers apply statistical rigor before making major decisions. A search term with 7 conversions from 267 clicks (2.62% conversion rate) has a wide confidence interval the true conversion rate could be anywhere from 1.5% to 4%. You wouldn’t dramatically increase bids based on this limited data. Conversely, a search term with 52 conversions from 1,834 clicks (2.83% conversion rate) has a narrow confidence interval you can be confident this reflects true performance. Use statistical significance calculators to determine when you have enough data to make reliable decisions.

Match Type Strategy Refinement

The “Matched broad” and “Matched phrase” indicators show which of your keywords triggered each search term. If you notice that your broad match keywords are triggering many irrelevant searches, you might tighten your strategy by shifting to phrase match or exact match only. Conversely, if broad match is discovering many valuable search terms you hadn’t considered, it validates using some broad match keywords as “discovery engines” that reveal new targeting opportunities, which you then capture explicitly by adding them as exact match keywords.

Negative Keyword Themes

Beyond individual search terms, professional performance marketers identify negative keyword themes. If you see multiple search terms containing “free,” “cheap,” “jobs,” “tutorial,” “DIY,” or other modifiers that indicate users who won’t convert, you’d add these as broad match negative keywords to prevent future related matches. This proactive approach saves budget before waste accumulates. Common negative keyword categories include: job-seeking terms, student/academic searches (if targeting businesses), competitor brand names (if not bidding on competitors), DIY/tutorial searches (if selling services not education), and geographic mismatches (if you see searches for locations you don’t serve).

Conversion Rate Analysis

Sorting by conversion rate (using the column header) reveals which search terms attract the highest-quality traffic. “Premium business software solutions” at 4.18% conversion rate is your strongest performer, suggesting this specific phrase indicates users with strong purchase intent and good product fit. “Business software free trial” at 2.76%, “affordable online platform pricing” at 3.06%, and “premium solutions for business” at 3.12% all cluster in the 2.7-3.2% range, indicating solid quality. Any search terms with conversion rates significantly below your account average (appears to be around 2.7-3%) warrant investigation are they attracting the wrong audience, matching through overly broad keywords, or sending users to suboptimal landing pages?

Cost Per Acquisition Ranking

Sorting by Cost/conv. reveals your most efficient search terms. “Business software free trial” at $11.22, “affordable online platform pricing” at $11.77, and “premium business software solutions” at $11.48 are your top performers, all well below your account average CPA. These terms deserve aggressive bidding to maximize volume at this efficiency level. “Enterprise solution companies” at $22.04 and “brand name login” at $26.76 are more expensive, requiring careful evaluation of whether customer value justifies acquisition cost. If enterprise customers are worth 5-10x standard customers, then $22.04 CPA might be highly profitable despite appearing expensive on the surface.

The Continuous Improvement Cycle

Professional performance marketers treat search terms review as a continuous improvement process, not a one-time task. Each week, they review new search terms that have accumulated sufficient data, promote 5-10 high-performers as keywords, add 10-20 irrelevant terms as negatives, and analyze patterns to refine overall strategy. Over months and years, this disciplined process compounds your keyword lists become increasingly refined to capture only valuable traffic, your negative keyword lists eliminate increasingly obscure irrelevant searches, and your cost per acquisition steadily improves as you systematically eliminate waste and scale winners. The accounts that achieve sustainable competitive advantage aren’t those with the biggest budgets or flashiest creative they’re those with the most sophisticated search terms management, executed with discipline through this exact view. This is where the rubber meets the road in search advertising: real user behavior meeting your targeting strategy, with clear data on what works and what doesn’t, enabling systematic optimization that separates top-performing marketers from the rest.

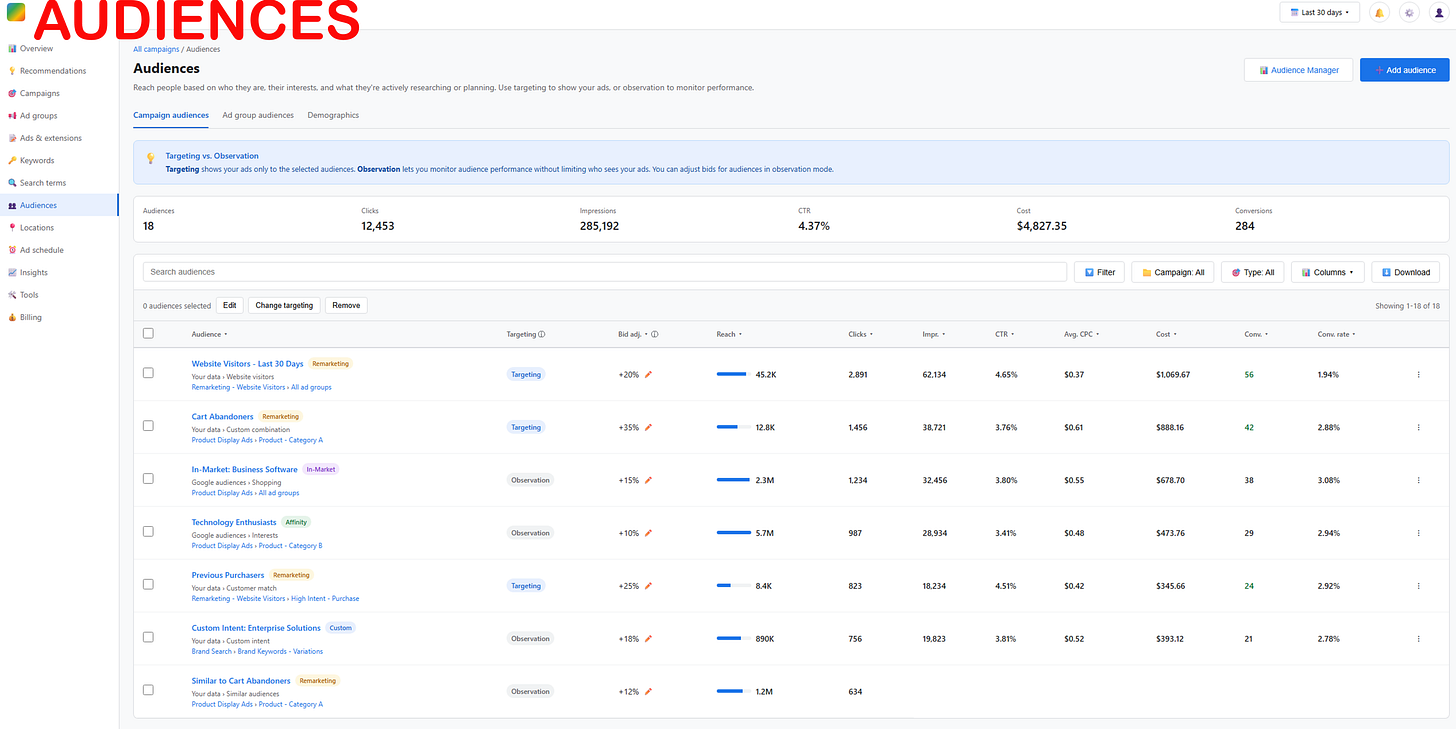

AUDIENCES

The Audiences view represents the evolution of digital advertising from simple keyword targeting to sophisticated behavioral and intent-based marketing. This is where professional performance marketers leverage first-party data, platform intelligence, and market insights to reach users based on who they are, what they’re interested in, and where they are in the customer journey not just what they search for. Mastering audience targeting is what separates modern performance marketers from those still relying solely on traditional keyword strategies.

The Strategic Power of Audience Targeting

The description at the top captures the essence: “Reach people based on who they are, their interests, and what they’re actively researching or planning. Use targeting to show your ads, or observation to monitor performance.” Audience targeting allows you to layer behavioral and demographic data on top of keyword targeting, creating a multi-dimensional approach that identifies the most valuable prospects. Instead of just showing ads to anyone searching “premium software,” you can specifically target people searching “premium software” who are also technology decision-makers at mid-sized companies and have recently visited software review sites. This precision dramatically improves conversion rates and reduces wasted spend.

Targeting vs. Observation Modes

The blue highlighted box explains a critical strategic choice: “Targeting vs. Observation. Targeting shows your ads only to the selected audiences. Observation lets you monitor audience performance without limiting who sees your ads. You can adjust bids for audiences in observation mode.” This distinction is fundamental to sophisticated audience strategy. Targeting mode restricts your ads to only appear for users who match your audience criteria maximum control but potentially limiting reach. Observation mode shows ads to everyone matching your keywords but tracks performance by audience segment, allowing you to identify which audiences convert best and then adjust bids accordingly. Professional performance marketers typically start new audiences in observation mode to gather data without risking reach limitations, then switch to targeting mode once they’ve identified high-performing segments worth isolating.

Summary Performance Metrics

The aggregate view shows 18 audiences driving 12,453 clicks from 285,192 impressions (4.37% CTR) at $4,827.35 cost and 284 conversions. These audiences are layered across your campaigns and ad groups, providing an additional dimension of targeting sophistication beyond keywords alone. The fact that you’re running 18 different audience segments suggests a mature account with sophisticated segmentation testing different behavioral signals, intent indicators, and demographic profiles to identify the most valuable customer segments.

Remarketing Audiences: The Efficiency Champions

The first row “Website Visitors - Last 30 Days” with an orange “Remarketing” tag shows your most efficient audience segment. With 2,891 clicks from 62,134 impressions (4.65% CTR), 56 conversions at 1.94% conversion rate, $1,069.67 cost, and critically a +20% bid adjustment (shown by the pencil icon), this audience represents users who’ve already visited your website in the past 30 days. The breadcrumb “Your data > Website visitors > Remarketing > Website Visitors > All ad groups” shows this is a first-party audience built from your website traffic data. Remarketing audiences almost always deliver the best performance because these users have already demonstrated interest in your products, making them far more likely to convert than cold traffic. The $0.37 average CPC (well below the $0.39 account average) reflects that you’re bidding aggressively on this high-value audience with the +20% modifier, yet still achieving efficiency due to strong relevance. The 45.2K reach indicates the size of your 30-day website visitor pool a healthy remarketing list that provides scale.

Cart Abandonment: High-Intent Recovery

The second row “Cart Abandoners” also tagged as “Remarketing” with a +35% bid adjustment shows 1,456 clicks from 38,721 impressions (3.76% CTR), 42 conversions at 2.88% conversion rate, and $888.16 cost. This audience targets users who added products to their cart but didn’t complete purchase one of the highest-intent segments possible because these users were literally seconds away from converting. The significantly higher conversion rate (2.88% vs. 1.94% for general website visitors) validates aggressive bidding with the +35% modifier. The 12.8K reach shows your cart abandonment audience size over the tracking window. A professional performance marketer would ensure this audience receives highly specific ad creative addressing common abandonment reasons offering limited-time discounts, emphasizing free shipping, highlighting security and easy returns, or using urgency messaging like “Complete your purchase - items selling fast!” The $21.14 cost per conversion (calculated from $888.16 / 42) is highly efficient, justifying the premium bids.

In-Market Audiences: Intent Signal Targeting

The third row “In-Market: Business Software” with a purple “In-Market” tag and +15% bid adjustment shows platform-identified users actively researching business software solutions. These aren’t your website visitors they’re users the advertising platform has identified through their broader search and browsing behavior across the internet as currently “in-market” for business software purchases. With 1,234 clicks from 32,456 impressions (3.80% CTR), 38 conversions at 3.08% conversion rate, and $678.70 cost, this in-market audience performs surprisingly well. The strong 3.08% conversion rate suggests the platform’s machine learning is accurately identifying high-intent users. The massive 2.3M reach indicates how many users the platform has tagged with this in-market signal. Professional performance marketers leverage in-market audiences to expand beyond their first-party data and keyword targeting to reach qualified prospects earlier in their buying journey before they search for specific solutions.

Affinity Audiences: Interest-Based Targeting

The fourth row “Technology Enthusiasts” with a purple “Affinity” tag and +10% bid adjustment represents broad interest-based targeting. Affinity audiences are users who have consistently shown interest in specific topics through their long-term browsing behavior in this case, technology topics. With 987 clicks from 28,934 impressions (3.41% CTR), 29 conversions at 2.94% conversion rate, and $473.76 cost, this audience performs reasonably well despite being broader than intent-based audiences. The 5.7M reach shows the massive scale of this audience millions of technology enthusiasts across the platform. While less efficient than remarketing or in-market audiences, affinity audiences provide scale for upper-funnel awareness campaigns. A professional performance marketer might use technology enthusiast audiences with display or video campaigns to build brand awareness, while reserving premium bids for higher-intent audiences on search campaigns.

Customer Match: First-Party Data Leverage

The fifth row “Previous Purchasers” with “Remarketing” tag and +25% bid adjustment shows a customer match audience your actual customers uploaded to the advertising platform. With 823 clicks from 18,234 impressions (4.51% CTR), 24 conversions at 2.92% conversion rate, and $345.66 cost, this audience is generating additional conversions from existing customers. These conversions likely represent upsells, cross-sells, subscription renewals, or additional purchases. The 8.4K reach indicates your customer list size. The breadcrumb “Your data > Custom audiences > Remarketing > Website Visitors > High Intent > Purchase” suggests sophisticated audience architecture where you’ve segmented customers by their purchase behavior. A professional performance marketer would further segment this audience perhaps separating high-value from low-value customers, recent from lapsed customers, or customers of different product categories to deliver hyper-personalized messaging and appropriate bidding strategies.

Custom Intent Audiences: Behavioral Signals

The sixth row “Custom Intent: Enterprise Solutions” with a purple “Custom” tag and +18% bid adjustment shows an audience you’ve defined based on specific URLs, apps, or keywords associated with enterprise software research. With 756 clicks from 19,823 impressions (3.81% CTR), 21 conversions at 2.78% conversion rate, and $393.12 cost, this custom intent audience allows you to reach users based on your unique understanding of your market. You might have built this audience by specifying competitors’ websites, industry review sites, or specific keywords that indicate enterprise software research. The 890K reach shows a substantial pool of users matching these custom signals. The breadcrumb “Your data > Custom audiences > Brand Search > Brand Keywords > Variations” indicates this audience is applied to your brand campaigns, helping you identify which brand searchers also show enterprise software research signals.

Similar Audiences: Lookalike Expansion